Sharp Corporation (hereinafter “Sharp”) decided and agreed with NEC Corporation (hereinafter “NEC”. NEC and its subsidiaries and affiliated companies shall be referred to as “NEC Group”) to acquire 66% of the shares of NEC Display Solutions, Ltd. (hereinafter “NDS”), a subsidiary of NEC, to become a subsidiary of Sharp and to be jointly operated with NEC as a joint venture.

1. Reason for Acquisition of Shares

NDS is in charge of BtoB display business within the NEC Group, with LCD display, professional projector, digital cinema products and solutions at its core development worldwide. Meanwhile, Sharp develops its BtoB display business with LCD display, electric whiteboard, professional projector, and 8K related equipment etc. in the Japanese market.

NDS holds strengths in the global market centering in Europe and North America, while Sharp has its strengths in the Japan market, making both parties mutually complementary, and various synergy effects can be expected by establishing a joint venture, such as scale merit, cross-selling of products, and business expansion in new categories such as LED display and 8K+5G Ecosystems with mutual cooperation.

As the above, Sharp views that making NDS its subsidiary and also a joint venture with the NEC Group will contribute to Sharp’s business growth by enforcing its BtoB business and expanding sales etc., and decided to acquire a majority of NDS shares.

2. Overview of the Acquisition

66% of NDS shares will be transferred from NEC to Sharp. The shares currently partially owned by NEC Networks & System Integration Corporation are scheduled to be transferred to NEC prior to the share transfer to Sharp, and NEC will hold all shares of NDS at that time.

With the above, NDS will become Sharp’s subsidiary as Sharp will hold 660/o of its shares. NEC will continue to hold 340/o of its shares to make NDS a joint venture between Sharp and NEC. Also, the following four subsidiaries of NDS will become Sharp’s subsidiaries with the above transfer of NDS becoming Sharp’s subsidiary.

- NEC Display Solutions of America, Inc.

- NEC Display Solutions Europe GmbH

- NEC Viewtechnology Trading (Shenzhen), Ltd.

- S[quadrat] GmbH

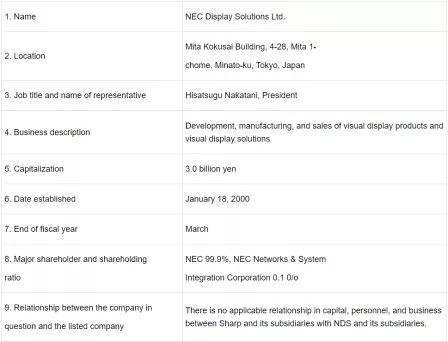

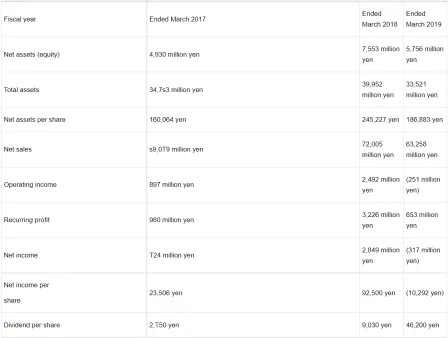

3. Overview of NDS

* Ended March 2019 net sales: 9T,370 million yen, operating income: 930 million yen (IFRS base). Surplus is maintained even on a non-consolidated base after excluding structural reform costs and initial investments toward new businesses.

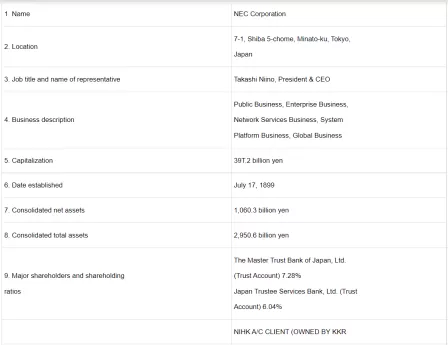

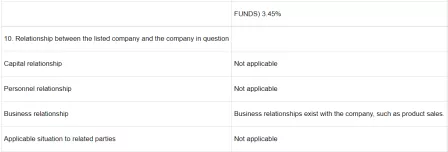

4. Overview of Counterparty to Share Acquisition Agreement (as of March 31, 2019)

5. Number of Shares to Be Transferred and Status of Share Ownership Before and After Transfer

Number of shares owned before the transfer: 0 shares (ownership percentage: 0%)

Number of shares to be transferred and consideration for same: 20,328 shares (ownership percentage: 66%) (9,240 million yen [*])

Number of shares owned after transfer: 20,328 shares (ownership percentage: 66%)

*Note: Consideration for this transfer is based on financial figures of the companies being transferred, including NDS, as of December 31, 2019. The ultimate transfer consideration may be adjusted ex post facto based on the financial figures at the time of transfer.

6. Schedule

Contract signing date: March 25, 2020

Share transfer date: July, 1, 2020 (scheduled)

The date is subject to change according to progress of Competition Law Permit etc.

7. Future Prospects

The impact of this transaction on consolidated performance is minor.